| Home | About Us | Resources | Archive | Free Reports | Market Window |

Should You Buy at New Lows? Or New Highs?By

Tuesday, February 26, 2013

You might not agree with today's lesson... But it's based on numbers going back nearly 100 years.

Last month, I told you even though stocks are way up and hitting levels that have preceded major corrections in the past, it is NOT time to sell.

It might be scary to hang on with stocks near all-time highs. But as I explained, it's the right thing to do today.

And it's been the right thing to do throughout recent history. Let's take a look at the facts...

With our True Wealth Systems databases, we have the best financial data on the planet at our fingertips. We can test just about anything to find ideas that make money.

You see, when stocks hit a new 12-month high, people get scared... They sell. They get worried that the market must be about to fall. On the other hand, when stocks hit a new low, they might figure they're getting them "on sale."

So we tested which strategy works better: Buying near 52-week lows... or buying at 52-week highs. We looked at nearly 100 years of weekly data on the S&P 500 Index, not counting dividends.

You might be surprised at what we found...

After the stock market hits a 52-week high, the compound annual gain over the next year is 9.6%. That is a phenomenal outperformance over the long-term "buy and hold" return, which was 5.6% a year.

On the flip side, buying when the stock market is at or near new lows leads to terrible performance over the next 12 months... Specifically, buying anytime stocks are within 6% of their 52-week lows leads to compound annual gain of 0%. That's correct, no gain at all 12 months later.

Using monthly data, our True Wealth Systems databases go back to 1791. The results are similar... Buying at a 12-month high and holding for 12 months beats the return of buy-and-hold. And buying at a 12-month low and holding for a year does worse than buy-and-hold. Take a look...

The same holds true for a more recent time period, this time starting in 1950...

History's verdict is clear... You're much better off buying at new highs than at new lows.

You might not agree with it... but it's true.

We didn't "cherry pick" in our testing... We looked at 12-month lows and how stocks performed 12 months later. But you'll find similar results when you vary the number of months.

You might think you're getting a deal when you buy with the market at new lows. But it doesn't work.

And you might think buying at new highs "feels risky." But when it comes to the broad market, history shows you're better off buying at new highs than at new lows.

We're not making this stuff up... We're just asking our True Wealth Systems database for the facts... And these are the facts.

You might try to fight this... You might want to "catch a falling knife" and buy when stocks are at new lows. But if you do, realize you are fighting against more than 220 years of historical precedent.

Instead of fighting this... embrace it...

When the market hits a new high, DON'T sell. Enjoy it. New highs mean you're making money. And with history as your guide, you may have more new highs coming.

This idea can keep you from losing money by buying too early, and it can allow you to capture bigger gains by not selling too early. This is the big lesson. Don't forget it...

Good investing,

Steve

Further Reading:

If you had invested following the principles of the True Wealth Systems gold strategy, you could have turned $10,000 into more than $3 million. The system is powerful, yet incredibly simple. You can learn the basics of how it works and what it's saying about gold today here: What Our 47%-a-Year Gold System Says Now.

Steve recently used the True Wealth Systems computers to help discredit one of the biggest lies about investing. It's a lie told by "expert" after "expert" on the financial news. It sounds believable... but it's completely incorrect. Get the details here: The Biggest Lie in Investing... That You Actually Believe.

Market NotesA BULLISH DISPLAY FOR URANIUM STOCKS If you're long uranium, you're getting good news from the market.

Over the past few months, we've featured bullish commentary on uranium, which is the fuel that fires nuclear power plants. Some of the brightest investors we know see uranium as a tremendous bargain. (Read this interview with Rick Rule for specifics.)

Uranium stocks sold off heavily in 2011 after the Fukushima disaster. But in the past few months, uranium stocks, like giant producer Cameco, have put on an impressive performance. Uranium miners are gaining while mining shares in general are tanking.

There are many types of mining sectors, and each one has its own specific quirks. But the industry as a whole tends to move together. It's tough for individual sectors to "buck" a big downtrend. But that's exactly what Cameco (NYSE: CCJ)and the uranium industry are doing...

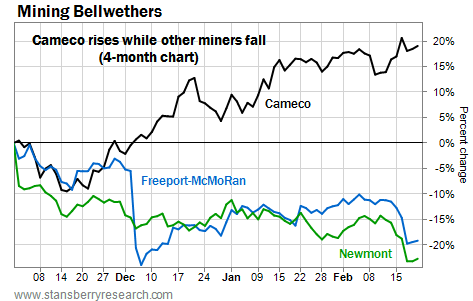

To show you what's happening, we consult a four-month "performance chart." The chart below plots the performance of Cameco and two other mining "bellwethers," Newmont Mining (gold) and Freeport-McMoRan (copper).

Since the broad market began its rally in November, Cameco has rallied along with it. Shares have gained 18% in the past four months. Meanwhile, Newmont and Freeport (and most every other mining stock) have been clobbered. It's a bullish display of "relative strength" for uranium.

– Brian Hunt

|

In The Daily Crux

Recent Articles

|

|||||||||||||||||||